Have you heard about CFDs? If not, you probably wonder: “What is a CFD?”. CFD stands for “contract for difference”. It is a contract between two parties, a “buyer” and “seller”, according to which the buyer will pay the seller the difference between the current value of an asset (opening price) and its value at contract time (closing price). If the difference is negative, then the seller pays instead to the buyer.

CFD is a universal trading instrument that provides an opportunity to earn from the price movements of various assets: indices, stocks, futures without the need to actually buy and physically hold them.

Let’s take an example: you purchased a CFD on Brent crude oil, and the asset’s price went up. In this case, the brokerage company that sold it to you will pay the corresponding difference to you. If the price falls, the broker will deduct this difference from your trading account.

Where to trade CFDs?

CFDs were initially used by hedge funds and institutional traders to secure their positions on stocks on the London Stock Exchange. Later, brokerage companies began to expand their CFD offerings. CFDs were introduced for a range of other underlying assets, such as commodities, bonds and foreign exchange (currencies).

Contracts that are based on key indices such as the S&P 500, Dow Jones and DAX quickly gained popularity. Stock CFDs are especially in demand.

Now, CFDs are available on almost all existing financial assets. But there’s no separate marketplace, say, an exchange, to trade CFDs. Many brokers offer CFDs in all the world’s major markets. For example, you can trade CFD with a global online broker AMarkets, which allows around-the-clock access.

What types of CFDs are there and how to trade them?

There are several underlying assets you can trade with CFDs:

- Foreign exchange market assets, including currency pairs.

- The bond owner can receive (at the indicated time) the par value of the asset from an entity that issued these securities.

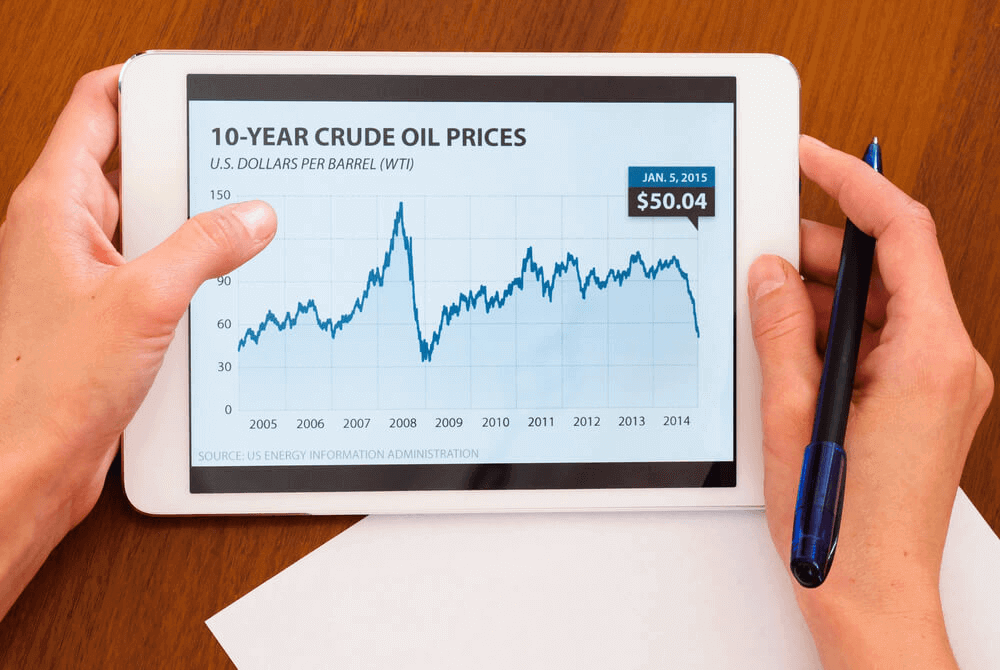

- Oil, gold, silver, etc.

- Allows you to receive income from dividends or price difference.

- A financial instrument that measures the performance of a basket of securities intended to replicate a certain area of the market.

When placing a CFD order, a trader specifies the amount and rate, projecting whether the asset will rise or fall. So, if a trader thinks that the asset’s price will rise, he buys it, and if he believes that the price will go down, he sells.

If the projection is correct, the trader’s profit will increase as the price moves in the specified direction.

Example of a contract

For example, Coca-Cola stocks are trading at $100 per share. An investor buys CFDs on 1000 shares. If the price rises to $105, the broker will pay the investor $5,000. If the price dips to $95, the broker will charge the investor this amount.

The contract doesn’t imply that the investor must physically own the shares, which allows him to avoid registering ownership of assets and the associated costs.

CFD Trading Strategies

To make CFD trading more profitable and less risky, traders have developed a number of strategies.

- Intraweek trading. It means that trading is carried out during the week. An investor opens a trade on Tuesday and closes it at any time before Friday.

- Long-term trading. In this case, the position is held for more than 1 week.

- Combined trading. Traders combine automated and manual trading methods. This option is more suitable for professionals.

- Traders often use CFD trades to hedge an existing physical portfolio.

CFD trading: Pros and cons

Advantages of CFD trading

- Wide range of assets. You can trade CFDs on a wide range of assets. CFDs are the best tool if you need to diversify your portfolio.

- High leverage. When trading CFDs, you can use larger leverage (up to 1:500) compared to the stock market. This ensures a low margin, about 2%. Depending on the underlying asset, however, the margin can be higher, up to 20%, but it won’t exceed this level. Thus, even with a small deposit, a trader can reach the markets that were previously inaccessible to him.

- Using a single trading platform, a trader can access multiple markets. Many CFD brokers offer assets from all global markets.

- No restrictions on short-selling. A number of markets prohibit short-selling or require a trader to borrow an asset if a trader wishes to take a short position. The CFD market does not impose any limits on short positions. A trader is allowed to go both long and short at any time without incurring additional costs.

- No commissions. Trades are executed quickly and, as a rule, commission-free.

- No day trading requirements. Unlike certain markets, CFDs do not require minimum capital to day trade or place limits on the number of day trades.

Disadvantages of CFD trading

- CFD trading isn’t suitable for scalpers, who profit from small price moves. All expenses are included in the spread. For example, the spread on EUR/USD can be as high as 30 pips, while on Forex, it’s 5-16 pips. So, while to trade in traditional markets, the trader pays fees, commissions and has to deal with higher capital requirements, CFDs can trim traders’ profits through spread costs.

- Weak industry regulation. Compared to, say, the stock market, the CFD industry is weekly regulated. So before trusting a broker with your money, it’s important to research the company and its background before opening an account.

How much money do you need to trade CFDs?

The answer to this question depends on the minimum deposit requirement of the chosen brokerage company.

You can start trading with only $100 in your account.

At the same time, you get the chance to trade the securities of various international companies. The most important thing is to account for the margin and avoid taking a large number of positions at once. CFDs are perfect for beginners who want to try their hand at trading with a small investment.

CFDs vs. Forex: comparison

Forex and CFD trading have both similarities and differences. Let’s take a look at them so that you can make your choice depending on your targets and needs.

What are the similarities between CFDs and Forex?

- Both CFD trading and Forex trading do not require the actual ownership of the underlying asset. So, trades are executed almost identically. Both offer margin trading. The leverage used by traders when working with CFDs is expressed as a ratio (1:100).

- The only cost of trading is the spread, as opposed to other types of trading instruments that charge commissions and other fees.

What are the differences between CFDs and Forex?

- CFD is a universal trading instrument that allows you to trade various markets and their assets: indices, stocks, cryptocurrency, metals, etc., whereas Forex offers pure currency trading.

- Forex is open 24 hours a day, 5 days a week, while CFDs are trading depending on the market and the chosen asset.

Summing up

CFD trading allows you to access multiple markets and a wide range of financial instruments: from metals to stocks of large companies.

At the same time, the work process is much easier, thanks to a free trading platform, lower commissions and leverage.

Consequently, the trader has more opportunities to profit from trading.

Did you like this article? We regularly update our blog with new materials. We also recommend following us on Instagram and Facebook, where we publish market analysis and news about our current bonuses and promotions.