Article content

Should you buy Bitcoin at $20k or wait for an even bigger drop?

There are many arguments in favor of not postponing the purchase of the flagship crypto. The arguments are pretty strong.

Bitcoin is a classic cryptocurrency, purchased for a long-term period. Bitcoin is not traded speculatively, but for HODLing purposes. So, market whales (large investment banks and other institutional players) buy BTC at every correction.

The largest investor in BTC is the Microstrategy fund, which has been accumulating bitcoin since 2020. The number two investor is electric car maker Tesla.

Top 10 public companies, the largest BTC holders. Source: buybitcoinworldwide.com

∎ Bitcoin is the only asset not subject to inflation. On the contrary, BTC is a deflationary asset due to the limited ability to issue new coins. Only 21 million units of BTC can be mined across the world.

∎ The difficulty of Bitcoin mining is increasing every year against the backdrop of a declining supply of coins. The constant rise in energy prices is a factor that constantly increases the cost of mining a coin.

∎ The so-called mass adoption of BTC is on the rise. More and more countries, industries, network retailers, and financial institutions are starting to use crypto on a par with fiat money. The denser the introduction of the crypto into the real economy (as a means of payment, collateral, insurance, etc.), the higher the value of the coin. The coin’s utility is growing and this is the case.

Let’s view some stats.

Statistical data in favor of further BTC strengthening

According to Blockware Intelligence research, global Bitcoin adoption will reach 10% by 2030.

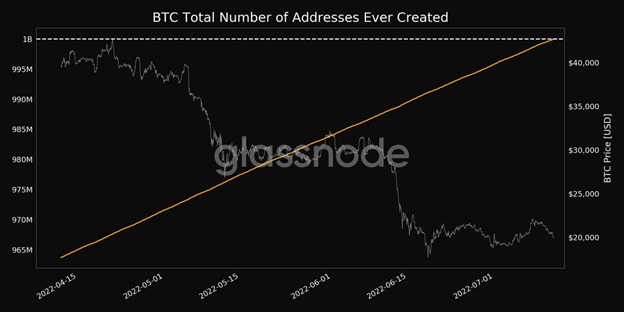

And it follows from the Glassnode report that there are already more than a billion BTC addresses. This is the same if every seventh inhabitant of the planet created their own BTC wallet.

Graph 1. The total number of BTC addresses created. Source: Glassnode.

And here are some positive thoughts.

The Financial Stability Board recently stated that it would be ready to propose “reliable” global rules for the cryptocurrency segment as early as October 2022.

The FSB is a very powerful G20 watchdog made up of regulators, treasury officials, and G20 central bankers. It is important to note that, until now, the FSB has limited itself to monitoring the crypto sector without interfering in the process.

From this, we can make a bold assumption that by the end of the year the cryptocurrency has a chance to expand the field of legalization in most countries of the world. If it so happens that from 2024 a new round of growth will begin for the entire blockchain segment.

Why is it profitable to buy BTC right now?

$20,000 is an objectively low cost for BTC due to a combination of unfavorable factors (low demand for risky assets, the US and EU weakness, brutal inflation, geopolitics, etc.).

As long as the crypto prices are still EXTREMELY bearish, it makes sense to buy BTC and altcoins, both for HOLDLing and short-term investing purposes.

Do you want to invest in Bitcoin, altcoins, and other assets? Open an account with an international online broker and earn on the financial markets in a comfortable mode.