Article content

Hedging and Netting definitions

Today we are going to tell you about Netting and Hedging systems in trading. We will try to figure out what it means and find out and explain pros and cons of each system.

MetaTrader 5 supports two order accounting modes: the netting mode is adopted on exchange markets, while the hedging method can be used for Forex trading. With the netting system, the trader will be able to have only one open position of a financial instrument at a time. The volume of that position can be increased or reduced through any further operation on the same symbol. With the hedging system, any new deal on a financial instrument opens a new position.

While RAMM platform has only 1 accounting mode which is Netting because only netting allows achieving high accuracy in copying process.

The Netting system allows only one position open in any direction for one instrument. The system is used all over the market. To put it simpler, the trader cannot open a selling and buying position on one instrument simultaneously – the positions mutually close, the orders open in one direction summing up.

The Hedging system allows as many open positions in different directions as you wish.

Let’s see some examples:

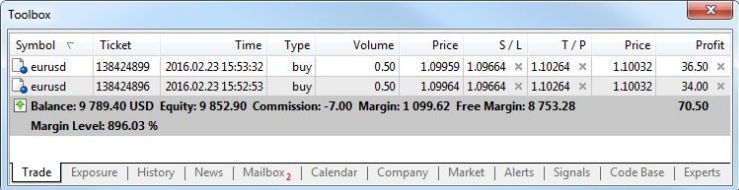

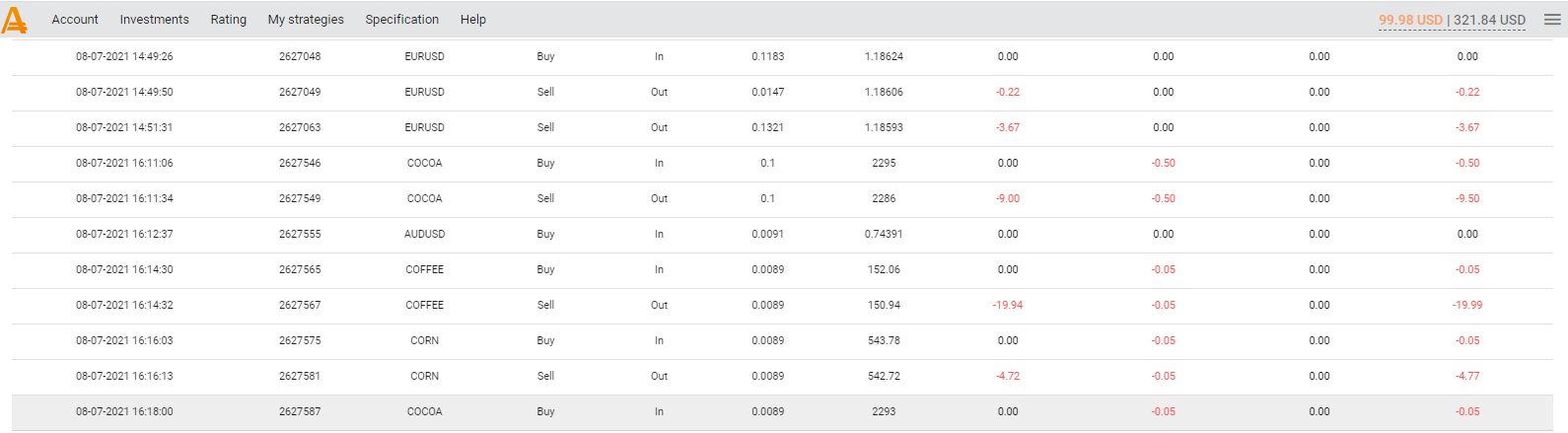

Hedging

Let us imagine a trader opened a buy position on EUR/USD (the opening price is now irrelevant). The volume is 0.5 lots. Sometime later, the trader decided to open sell position on this instrument, which is also sized 0.5 lots. With the Hedging system, these two positions will be opened separately.

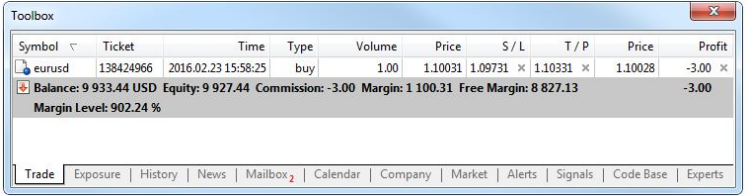

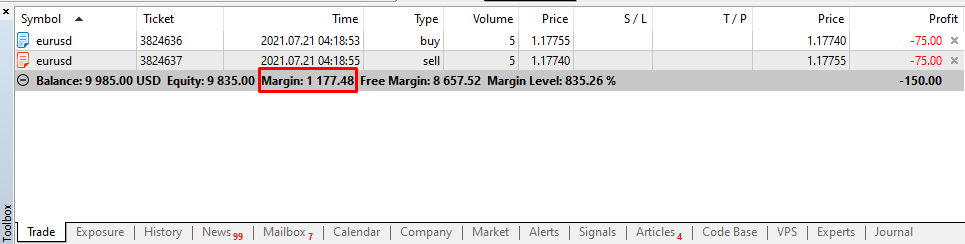

Netting

Thus, if you open an extra open position for the same symbol which you already have an existing open position, the new position will be added to the existing position, and it will either increase or decrease the trading volume.

The screenshot below shows an example of “Netting System” when you buy 0.5 lot for EURUSD twice.

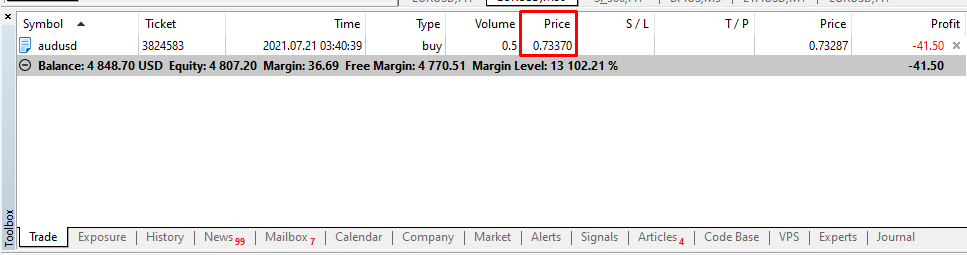

Another example:

The volume is 1 lot buy position. Sometime later, the trader decided to open a selling position on this instrument, which is sized 2 lots. With the Netting system his 1 lot buy position will be closed and the total position will become 1 lot sell.

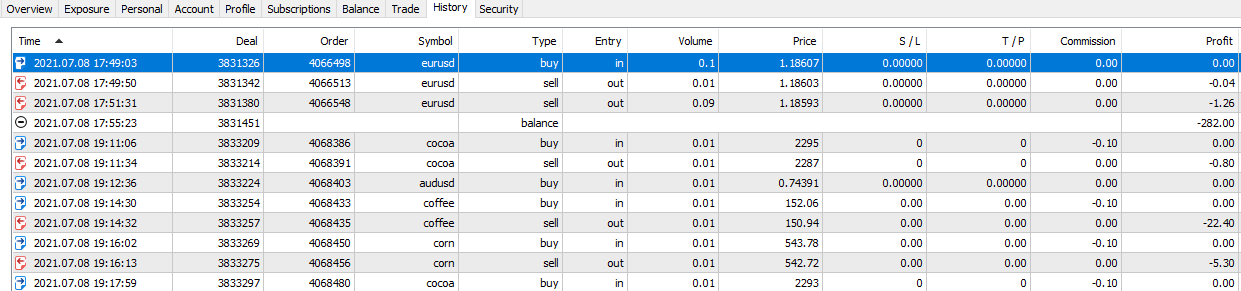

Here is the comparison table for you to summarize the specificities of each accounting system:

| Features | Hedging | Netting |

| Accuracy of the copying | ❌ | ✅ |

| Opening multiple positions for the same instrument | ✅ | ❌ |

| Reversing the positions | ❌ | ✅ |

| RAMM Platform | ❌ | ✅ |

| Hedging / Locking positions | ✅ | ❌ |

| Averaging | ✅ | ✅ |

Are there any pros and cons for these systems?

No doubt, both systems have their pros and cons.

For those who use locks a lot, Netting may be uncomfortable, as well as averaging. On the other hand, for sure there are a lot of advantages with Netting:

1) The trader will not get a lock randomly or by a mistake, which means he will not pay an additional spread.

2) For example, an open price for position in a downtrend may be corrected by averaging: the price of the first open order changes, the slump in points reduces and the chance to close all positions with a profit enhances. Imagine that trader opens Buy position when the market is falling. It keeps falling, giving losses to trader. If trader opens a new long positions and waiting till the market pull back, his opening price will be changed and become lower because he has second deal which was opened lower.

3) RAMM system for investors works only with netting. It means that both trader and investor will have the same vision of their trades. Investor will have the same vision of their trades.

4) Imagine the trader gets into a full lock and he has hedging MT5, while the investor has these positions closed due to the netting accounting system. In such a case, a yield charts may be different if the trader closes the locked positions and the investor may not have enough funds to open new positions with the volume that was opened before the locked positions. This can lead to less volume copied to the investor taking into account the ratio of deposits and factor. So, netting system both for traders and investors is a great solution to avoid discrepancy in yields and yield charts.

5) Hedged positions always require margin. That’s can be inconvenient for those traders who can’t manage their locked accounts in drawdown.

So, as you can see, netting has its own benefits as well. One more thing that we would like to share with you is the example that even if trader has a lock with hedging, there will not be any difference in profits or losses for investors:

Imagine, that trader has hedging and 1 lot of buy position (with loss 100 USD), investor in this case has 1 lot of buy position as well. Once trader decided to lock his position and open 1 lot sell (which becomes -20 USD due to spread which is also payable when trader opens lock), investor doesn’t have any positions, because his buy position is closed now without paying spread. So, at this step, trader with hedging mode has 20 USD more losses than investor.

For example, the result for the long position is -200 USD and for his sell position +80 USD because results change together.

Next, price reached some important levels like support or resistance and trader decides to open his lock by closing his sell position. After this he has only bought position which should be opened for investor. So, it opens and now investor pays spread in the amount of 20 USD and both of them has the same long position. But you’ll probably ask how’s that possible if the opening price for the long position is different from that one which the trader has. We remember, that investor has -100 USD result fixed and -20 USD paid as a spread for the buy position opening while trader has +80 USD fixed from his sell position and -200 USD floating loss.

Thus, they both have the same total result -120 USD which means that there is no difference between Hedging/Netting in amount of profits/losses and they both have the same Buy position.

Please, note that you can use your experts advisors with netting accounting system as well as you use it with hedging system. Moreover, you can always test your EA as well as your strategy on demo accounts which you can open in your personal area.

You can find more interesting articles in our blog! Don’t forget to subscribe to our social media: